2014-Q3 was the third quarter of normal trading for Credebt Exchange®. Debtors increased to 390+ with the total trade value of €13.1m YTD. Daily volumes increased by 17% on the previous quarter, 2014-Q2. Highest single value trade was in July at € 0.38m...

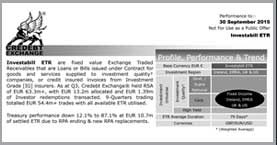

Investabill ETR are fixed value Exchange Traded Receivables, that are loans or bills issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at Q3, Credebt Exchange® held RSA of EUR 63.3m+, with EUR 13.2m allocated and EUR 1.39m of Investor redemptions transacted. 9-Quarters trading totalled EUR 54.4m+ trades with all available ETR utilised.

Treasury performance down 12.1% to 87.1% at EUR 10.7m of settled ETR due to RPA ending & new RPA replacements.