Investabill® enables investors to earn attractive returns on investments in the performance of quality companies globally.

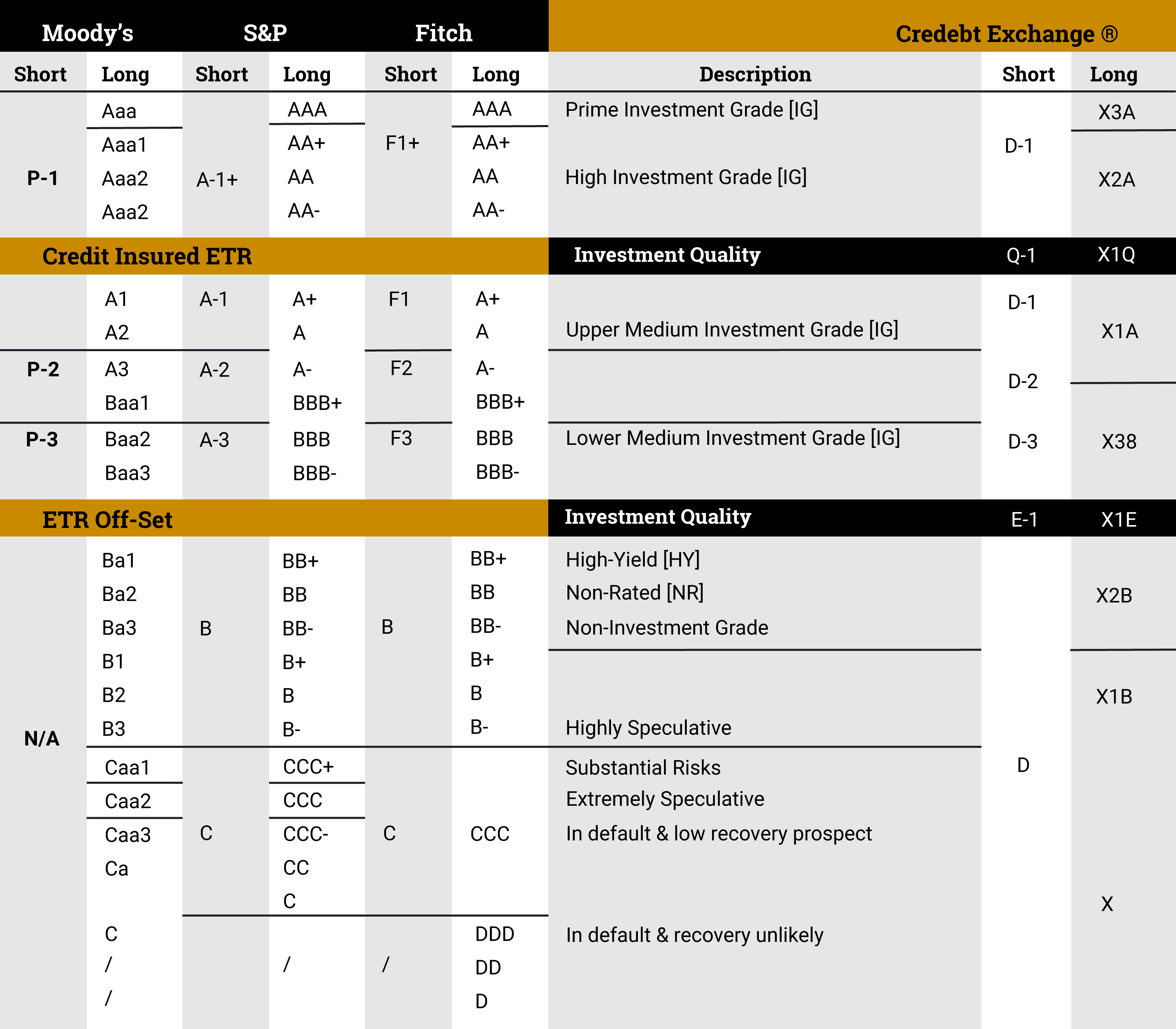

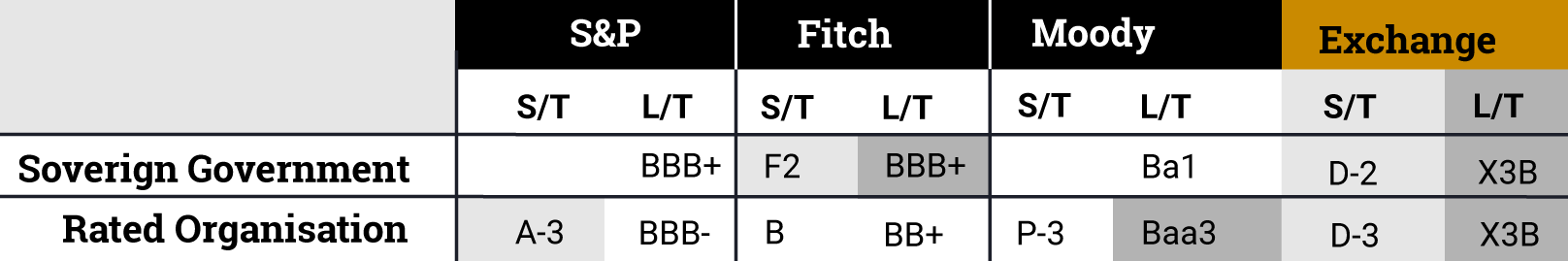

Investments are secure, insured and liquid.

Investors can expect higher returns than bank deposits,

with similar security and liquidity.

To date, investors have put more than EUR 300 million into Investabill®.

There is no minimum or maximum amount that can be invested.

By going through one of our registered intermediaries or

brokers, investors can access the world of Investabill®.

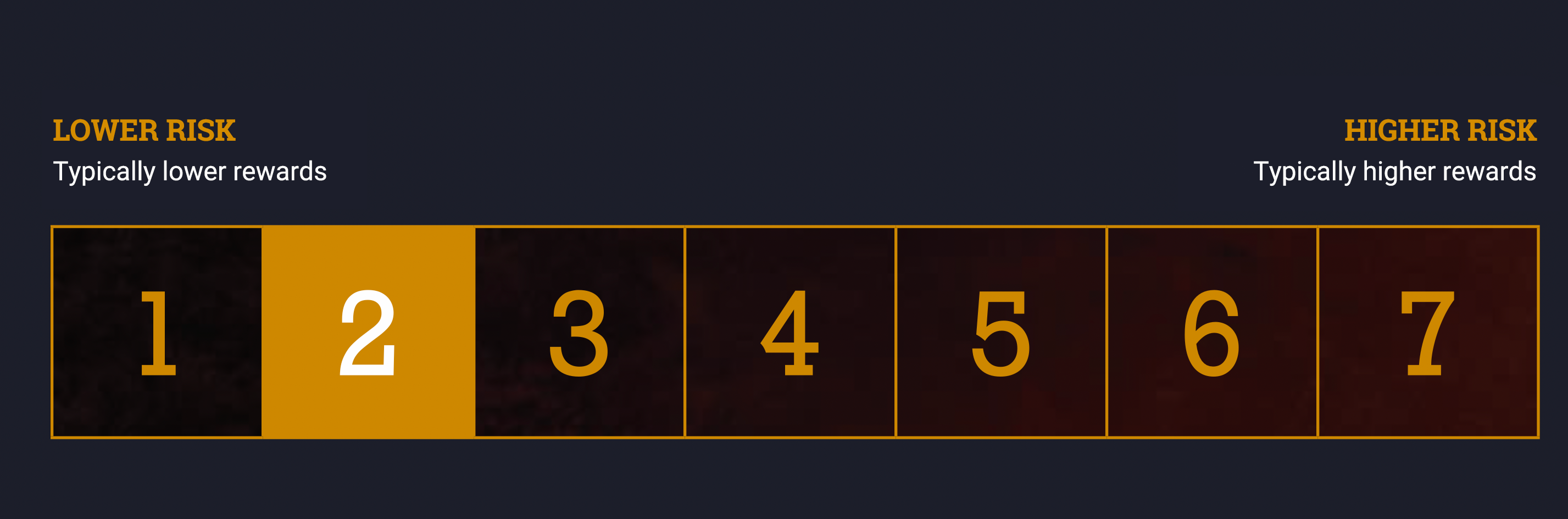

Investors may choose their preferred risk and return option.