2019-M08 v 2018-M08 showed a continued decrease in trade volume of 43.93% with a significant drop in trade value of more than 18.35% in the month. As the availability of SME trade credit continues to increase, the overall year-on-year decrease for the Exchange showed c...

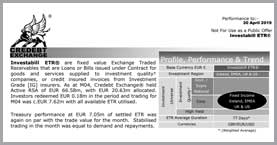

Investabill ETR® are fixed value Exchange Traded Receivables that are loans or bills issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M04, Credebt Exchange® held Active RSA of EUR 66.58m, with EUR 20.63m allocated. Investors redeemed EUR 0.18m in the period and trading for M04 was c.EUR 7.62m with all available ETR utilised.

Treasury performance at EUR 7.05m of settled ETR was again on par with the trade value for the month. Stabilised trading in the month was equal to demand and repayments.