Credebt Exchange

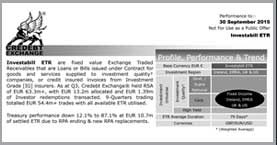

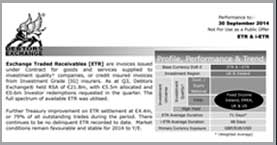

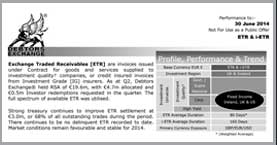

Since its foundation in 2011, Credebt Exchange® has been purchasing invoices on a revolving basis from Originators that are members of the Exchange. These invoice, or Exchange Traded Receivables [ETR], are payable by the Originators’ customers, or Debtors.

Effective 16 January 2015, Credebt Exchange Limited, with company registration number IE501210, officially changed its name to Credebt Exchange Limited. Credebt Exchange will continue the Credebt Exchange business model and will add a new product that pays Originators’ suppliers, or Creditors, too. The improved business model of paying Creditor invoices and purchasing Debtor invoices, led to the creation of the word: Credebt.

This blended business model is called Convertibill™ and is designed to further enhance cash flow for the Credebt Exchange Originators whilst also reducing their overall cost of funds. This is achieved by enabling Originators to offer their suppliers ‘payment on demand’ for a nominal discount. The discount is then offset against the cost of selling their customer invoices.

Over the coming months, wherever the Credebt Exchange name appears, it will be replaced by Credebt Exchange. Both new and existing Credebt Exchange Originators will be invited to avail of the payment on demand service for their suppliers and to continue sell their customer invoices using the Convertibill™ product offering.

During 2015-Q1, the Credebt Exchange extended product offering for Investors will be marketed under the product name Investabill™. As a sophisticated financial marketplace that facilitates the sale and purchase of Loans or Bills as Exchange Traded Receivables [ETR] or Investabills™. These ETR Investabills™ will continue to trade and generate the working capital Originators require.